-

AuthorPosts

-

1st July 2019 at 2:42 pm #72443

Hi All,

After a bit of advice please, I’ve had solid advice from here in the past so thought I’d try again. As I’ve mentioned before I got myself in a lot of trouble last year with payday loans etc for gambling, been 8 months gamble free now still in a lot of debt but the payments are manageable. My friend helped me with the payday loans, I’ve since paid him back, just stuck with 12k on credit cards 10% from max limit, and 2k on a personal loan.

I’ve read on the internet that ideally you need to be 70-75% from max limit on your credit cards so it doesn’t have a negative effect on credit rating. Will my credit rating increase before this point?

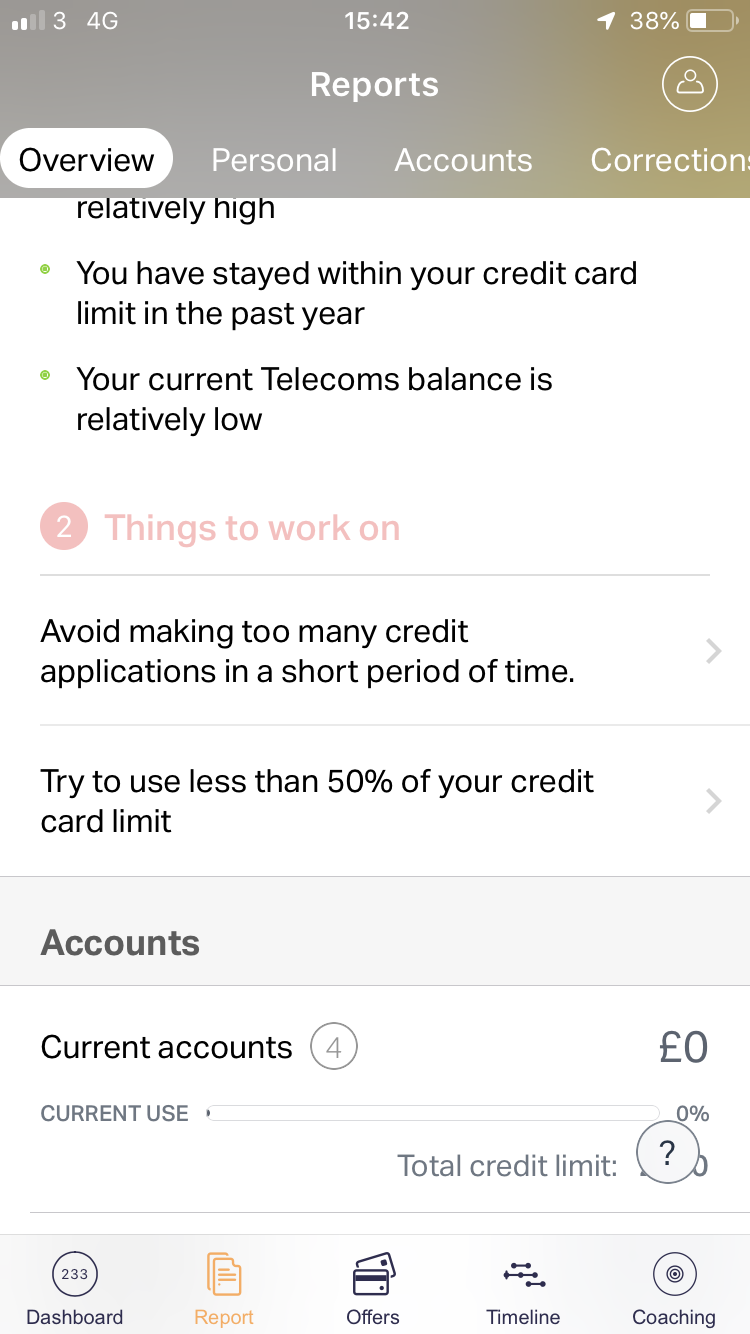

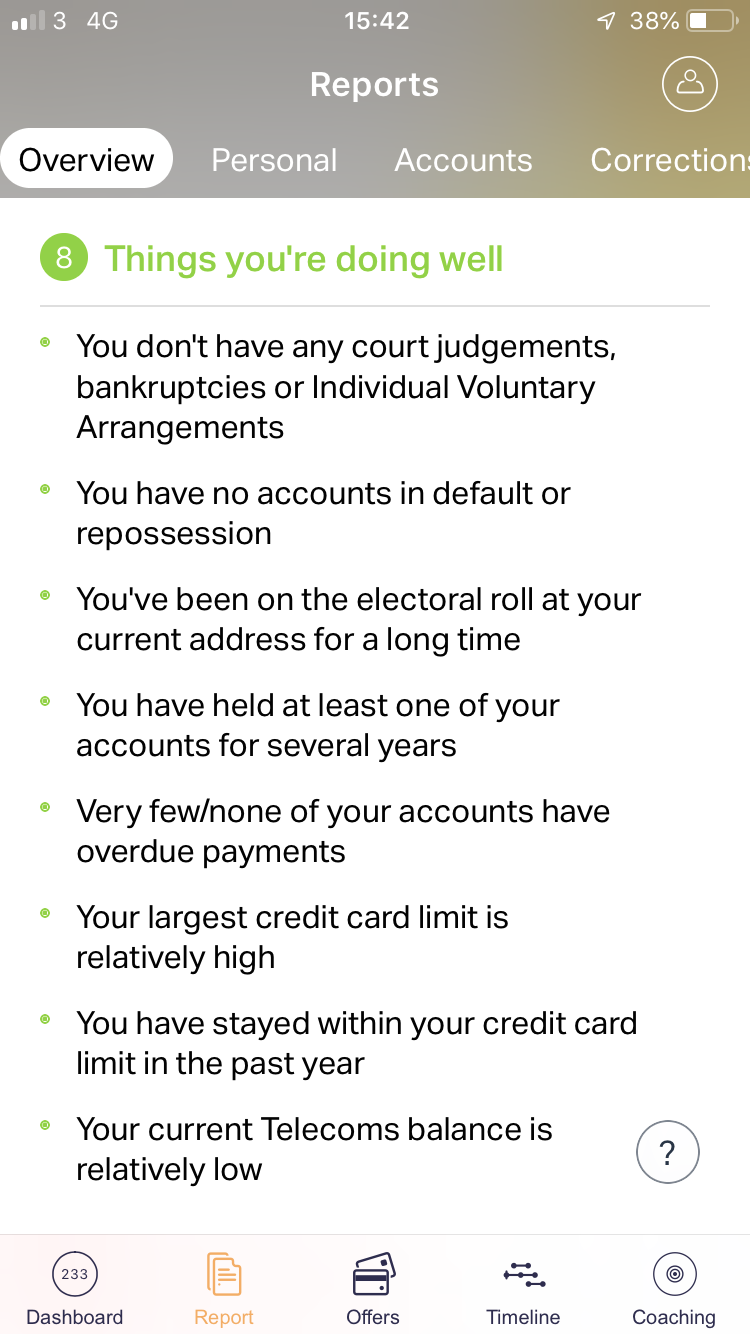

I’m ashamed to admit my credit rating is 233 out of 700 on clear score, I’ve never missed a payment but due to desperation last year my credit report is littered with searchers from Jun 18 to Nov 18. Will my credit rating increase as the searchers disappear each month? How quickly will it increase? I’d like to get a mortgage this time next year I’m worried my credit rating won’t be anywhere near good enough.

001st July 2019 at 3:01 pm #72444If you miss a payment on your c/card, it doesn’t reflect well on your credit score and will stay on your report for 6 months.

If you don’t pay more off the balance than the interest amounts to, you will be classed as being in persistent debt.

Ideally, 25% or less of available credit should be used, but anything over 50% and again, it reflects badly.

101st July 2019 at 3:07 pm #72445I’ve never missed a payment on my credit cards. I’ve started to pay more than the minimum payment, only just started to have some spare money.

001st July 2019 at 3:08 pm #72446Time and stability plus paying off your debts are the best ways to keep it up so sadly there’s no fast fix. Just do your best to get the debt shifted as best you can.

101st July 2019 at 3:08 pm #724471st July 2019 at 3:11 pm #72448I’d like a better idea on how much it can increase each month. It can drop 40 points in 1 month, can it increase by 40 points in 1 month?

001st July 2019 at 3:36 pm #72451Sorry to be bearer of bad news but any payments missed or even agreed reduced payments will have a negative effect on your credit report for 6 years. So even with the pay day loans if you missed anything in the last 6 years it will still be affecting your credit today.

001st July 2019 at 3:43 pm #724541st July 2019 at 3:47 pm #724551st July 2019 at 4:00 pm #72459Not too sure how they work the points up/down system but you seem to be doing ok. They do something called “hard searches” when you take out a card or loan. This initially impacts negatively on your credit score but if you keep up your repayments, which you have, then it will be a positive thing eventually. Your credit score must have taken a hell of a clout when you went mad for those few months late 2018.

My advice, pay off your debt, or at least 50% before getting a mortgage. This will help you get a better deal and your credit score will get better gradually. Don’t take any loans or more credit cards out.

101st July 2019 at 4:12 pm #72461Yeah it took a proper clouting, there’s loads of searches on my report I’m guessing these have brought my rating down, and the amount on my credit cards. If everything goes to plan I should be about 25% when applying for a mortgage, just got no idea if my credit score will be good by then

001st July 2019 at 4:40 pm #72466From the look of your report, you seem to be doing everything right mate so your score will naturally raise the more you pay off your credit cards to get and they reach that 50% spent on credit.

101st July 2019 at 4:53 pm #72469This thread got me taking a look at my rating and i noticed that 2 of the casinos i signed up for earlier this year took a look at me. Not surprised or anything just thought it was neat to see.

had a score of about 523, was telling me to get credit cards to up my score but ive always had a policy of not playing about with those.

001st July 2019 at 7:06 pm #72473I had a rating before Christmas of 986 (excellent) on credit expert with 85% total credit use on credit cards so don’t think it has to be below 50% usage, though it did drop like a stone to the fair category when I went over 90% usage. Still comfortably got a remortgage whilst only in the fair category 700ish.

The remortgage has made it further drop though, and annoyingly the new mortgage has been added but the debts I paid off nearly two months ago still appear. Funny how they add new debt to the file immediately but aren’t quick to change the debt to settled once paid off.

101st July 2019 at 7:25 pm #72479That’s good to know. Thanks for the advice everyone. A lot of searches will go over next few months so that might increase it

00 -

AuthorPosts

Copyright © 2025 backinamo.com | Terms & Conditions